DOGE Price Prediction: Analyzing the Path to Recovery Amid Market Volatility

#DOGE

- MACD shows early signs of bullish divergence despite current price weakness

- Bollinger Band positioning indicates potential oversold rebound opportunity

- ETF debut provides fundamental support offsetting short-term volatility concerns

DOGE Price Prediction

DOGE Technical Analysis: Key Indicators Signal Potential Rebound

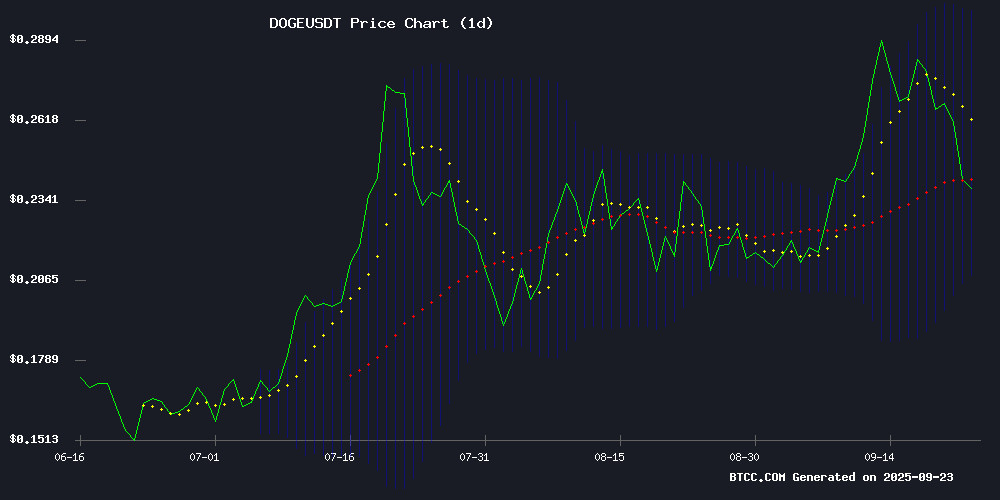

According to BTCC financial analyst Michael, DOGE currently trades at $0.23804, below its 20-day moving average of $0.253688. The MACD histogram shows a slight positive divergence at 0.001124, indicating weakening downward momentum. Bollinger Bands position the price NEAR the lower band at $0.207930, suggesting potential oversold conditions. Michael notes that 'the convergence of MACD improvement and proximity to Bollinger support could signal a near-term bounce toward the middle band at $0.2537.'

Market Sentiment: ETF Debut Offsets Short-Term Volatility Concerns

BTCC financial analyst Michael observes that 'while recent headlines highlight DOGE's 18% weekend plunge and struggle to hold $0.25 support, the strong debut of the Dogecoin ETF provides counterbalancing positive momentum.' Michael emphasizes that 'the ETF introduction represents institutional validation that may outweigh transient selloff pressures, though technical levels must be respected for sustained recovery.'

Factors Influencing DOGE's Price

Dogecoin ETF Debuts Strong as AI Tokens Gain Traction

The launch of Rex-Osprey's spot Dogecoin ETF has injected fresh optimism into the memecoin sector, marking a milestone for institutional adoption. Early trading volumes position it among 2025's top ETF rollouts, drawing parallels to Bitcoin and Ethereum's successful ETF trajectories. Market observers note the potential for DOGE to leverage its robust community support into sustained growth.

Meanwhile, attention is shifting toward AI-driven tokens like DeepSnitch AI, which analysts suggest could outperform traditional memecoins. The project's blend of hype and utility has sparked predictions of 300x returns, reflecting growing investor appetite for crypto assets with tangible technological applications. This divergence highlights a broader market trend favoring tokens that merge speculative appeal with real-world functionality.

Why Is Dogecoin Down Today, September 22, 2025?

Dogecoin (DOGE) faces significant downward pressure amid a broader market sell-off, with liquidations of long positions exacerbating the decline. The memecoin's failure to breach the $0.30 resistance level and its inability to hold above key moving averages have reinforced bearish sentiment.

Market volatility remains elevated, driven by speculative trading and high leverage in futures markets. Critical support levels to watch include $0.245-$0.255, with a breakdown potentially leading to a test of $0.225. A sustained recovery hinges on reclaiming momentum above $0.30.

Dogecoin Battles to Hold $0.25 Support Amid Market Volatility

Dogecoin's overnight plunge to $0.25 triggered a wave of liquidations, with trading volume spiking to 2.15 billion tokens—far above the 24-hour average of 344.8 million. The memecoin now faces a critical test at this support level, with resistance looming at $0.27.

Binance founder Changpeng Zhao likened the dip to building foundations: "Dips are important for establishing support levels, which are like foundations of a house." Analysts observe a "1-2 pattern" that historically precedes breakouts, suggesting potential upside targets at $0.28-$0.30 if buyers re-enter.

The $0.25 level serves as a make-or-break threshold. A failure to hold risks a slide toward $0.23, while consolidation could provide springboard for the next rally. Market watchers are scrutinizing whether this is the calm before another storm or the start of deeper correction.

Dogecoin Suffers 18% Weekend Plunge Amid Broad Crypto Selloff

Dogecoin led losses among major cryptocurrencies with an 11% single-day drop, erasing recent gains as trading volume spiked 83%. The memecoin now tests critical support at $0.23 after peaking near $0.27.

Despite the bloodbath, derivatives markets show remarkable resilience - 80% of traders maintain long positions. The selloff coincides with the rocky debut of REX-Osprey's DOGE ETF (DOJE), which fell 5.76% since its Thursday launch.

Market participants appear divided between panic selling and diamond-handed conviction. As one trader quipped, 'The dogs bark but the caravan moves on.' This volatility underscores crypto's maturation phase, where institutional products like DOJE collide with retail-driven meme assets.

How High Will DOGE Price Go?

Based on current technical and fundamental factors, BTCC financial analyst Michael projects DOGE could test resistance levels between $0.28-$0.30 in the coming weeks. The table below summarizes key price targets:

| Timeframe | Target Price | Catalyst |

|---|---|---|

| Short-term (1-2 weeks) | $0.26-$0.27 | Bollinger Middle Band convergence |

| Medium-term (3-4 weeks) | $0.28-$0.30 | ETF momentum and MACD recovery |

| Resistance Level | $0.299 | Bollinger Upper Band |

Michael cautions that 'while technical indicators suggest upward potential, maintaining above $0.25 support remains critical for this bullish scenario to unfold.'